Is it the Right Time to Start a Business?

It’s clear, pandemics are a health crisis that also cause economic disaster. It would appear as though we are only seeing the tip of the iceberg with hundreds of thousands of businesses going into hibernation, collapsing and permanently closing. For the first time in three decades Australia is officially in recession and we’ve seen Victorians especially experience an extended lockdown and subject to a curfew. But no State is in the clear as we saw recently with Adelaide experiencing a brief hard lockdown.

It has been described as a ‘perfect storm’ and we are sailing in uncharted waters. The media is flooding us with COVID-19 information and governments are using vocabulary that is normally reserved for war time. They are committing record amounts of money to assist business owners and employees but sadly, this recession spells financial doom for some businesses and industries including travel, events and entertainment are under threat. Given these facts and all the uncertainty, is it the right time to start a business?

Historically, business start-ups tend to surge when there are high levels of unemployment and middle management lose their jobs. Research also suggests that close to ten percent of the population are always planning to start a business. Our current circumstances are extreme but there’s never a perfect time to launch a business. At the moment people may be experiencing more focus and clarity regarding their priorities and vision. As such, provided you have done your homework that we touch on below, there is no reason to postpone your start-up plans.

.png)

If you’re in start-up mode, the most important advice we can offer you right now is, failing to plan is planning to fail. This serves as both advice and a warning because while it’s exciting when you have that light bulb moment and idea for a new business, starting (or buying) a business necessitates research, risk, passion and planning. While it’s hard not to get carried away with the excitement, starting a business is a process that can take months not days. There are very few shortcuts and no amount of enthusiasm, money, hard work or talent can guarantee business success.

Before You Pull The Business Trigger

If you’re thinking of quitting your job in favour of starting a business make sure you have done your homework. The Australian Bureau of Statistics reports that almost half of all new businesses close within three years of start-up. Make no mistake, the life of a new business owner can be a real roller coaster ride. The moment you transition from being an employee to being self-employed, your income is no longer guaranteed and you lose benefits like employer funded superannuation and 4 weeks annual holidays with pay. At the same time, your outgoings like your mortgage and car repayments remain unchanged. Running a business can be a financial pressure cooker and business ownership is not for everyone.

There’s no definitive DNA profile for what makes a successful entrepreneur, however, there are some key characteristics that entrepreneurs

share. Do you have the right personality, traits and skills to turn your idea into a viable business? As a guide, you need to be passionate

about your products or services and ideally you should have industry knowledge and experience. Remember, you are taking a financial risk and

it’s not for the faint hearted or novice. You need to be disciplined and decisive. If you’re a perfectionist think carefully about going

down this path because you might let perfection get in the way of progress. Very few entrepreneurs get their business model right the first

time so you need to be patient and listen to feedback from customers and even family members. At some point you might find you’ll need to

pivot and adjust your offering to changes in the market or consumer behaviour. The pandemic forced many businesses to shift their focus to

online sales with a click and collect option while others had to change to home delivery or provide take away only service.

There’s no definitive DNA profile for what makes a successful entrepreneur, however, there are some key characteristics that entrepreneurs

share. Do you have the right personality, traits and skills to turn your idea into a viable business? As a guide, you need to be passionate

about your products or services and ideally you should have industry knowledge and experience. Remember, you are taking a financial risk and

it’s not for the faint hearted or novice. You need to be disciplined and decisive. If you’re a perfectionist think carefully about going

down this path because you might let perfection get in the way of progress. Very few entrepreneurs get their business model right the first

time so you need to be patient and listen to feedback from customers and even family members. At some point you might find you’ll need to

pivot and adjust your offering to changes in the market or consumer behaviour. The pandemic forced many businesses to shift their focus to

online sales with a click and collect option while others had to change to home delivery or provide take away only service.

You’ll need a degree of resilience because you’ll make mistakes and rejection is inevitable. Not every customer, client or patient is going to like your product or service. Not only that, not every customer is going to like you personally. While confidence is an asset for an entrepreneur, arrogance is a liability. Of course, having networking abilities and being resourceful will work in your favour.

Before you pull the trigger on your new business there are a number of important things to consider including:

1. Why?

It’s an important question because running a business is challenging and there are risks and financially, there are no guarantees. You’ll work harder and probably longer than any role you’ve had as an employee and with skin in the game you’ll experience stress because it’s your money on the line.

The potential for financial rewards can motivate entrepreneurs as can the enormous satisfaction and sense of achievement that can be derived from turning your idea into profitable business. You get to control your own destiny and enjoy the freedom plus you’ll probably aspire to earn more money than you would as an employee. Having said that, you need to be crystal clear about why you want to start your own business. It’s going to be hard and be prepared to weather the storm of long hours, slow early sales and limited cash flow. You’re going to have to upskill because all of a sudden you could be the receptionist, production manager, bookkeeper, marketing manager and debt collector in the business.

You could be a great technician but suddenly you’re the ‘front man’ of the business that requires sales skills. It’s probably going to be different to anything else you’ve done before so be prepared to learn and adapt. You’ll need to be agile and think on your feet.

2. Who?

Another important question is who will buy your goods and services? Who is your ideal type of customer and what are your niche markets? Where do they hangout and how do you tap into their communication channels? The more specific you can be about your customers and your niche markets, the easier it is to tailor your brand and marketing. Identifying your target market can also help you make decisions about your location, pricing, social media channels and your marketing.

3. Know Your Competitors

Research your competitors and understand why they have a share of the market. This could involve visiting their premises, ‘stalking’ them on social media or dissecting their website with a fine-tooth comb. Understand their point of difference. Identify their strengths and weaknesses which should help you identify gaps in the market and opportunities.

What systems and technology are they using? Who are they targeting and how are they marketing to them? Gather intelligence about their products, services, prices and marketing. With that knowledge, it’s time to nail your unique selling point and competitive advantage. What can you do better than your competitors? Figure out how your business offering is going to be different (and ideally better) to your competitors. Starting a business without a deep understanding of your competitors is a huge mistake. Know their pricing, marketing, strengths and weaknesses.

4. Know the Laws in Your Industry

Every industry has its own rules, regulations and idiosyncrasies. You need to understand the laws and comply with them. Do your research and prepare a checklist of essential licences, registrations and council permits. Don’t flout council or government rules because your business could come to a grinding halt. Remember, these regulations can vary from council to council and state to state so do your homework on things like employment law, occupational health and safety plus your commercial lease. Consult with us about taxation issues including business registrations, superannuation for staff and Single Touch Payroll.

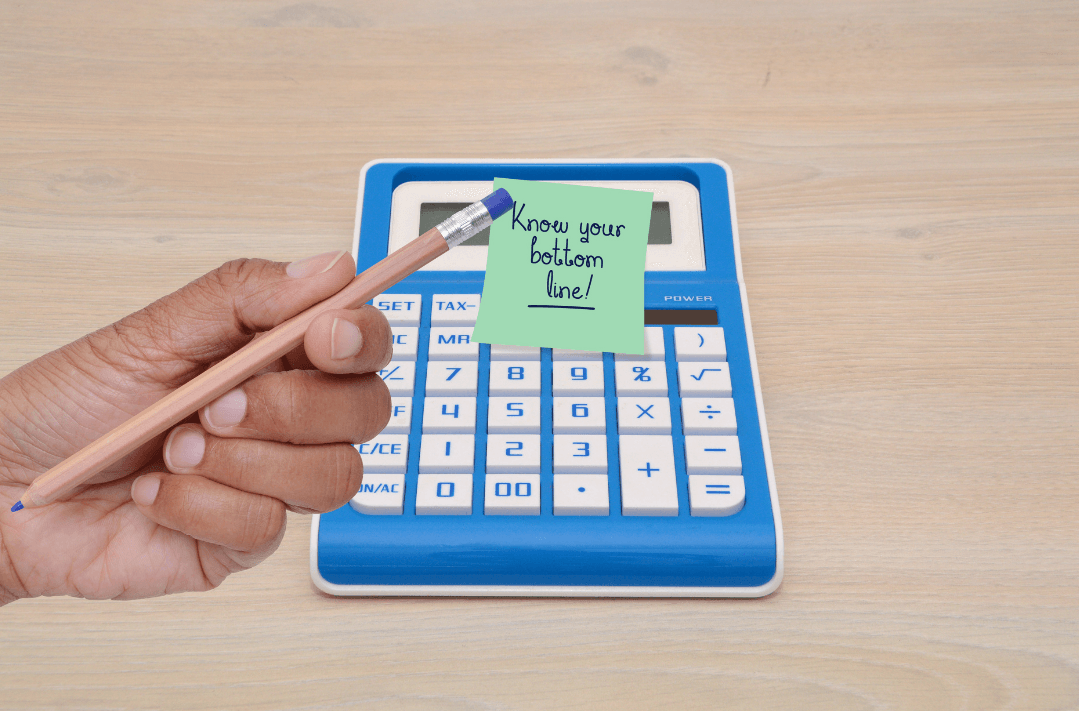

5. Know Your Numbers

You need to quantify your financial expectations. If the numbers don’t stack up, the business may not be viable and you could be on the verge of burning yourself out and burning a lot of cash in the process. If the projected profits aren’t enough to justify the risk and hard work, it could be time to revise your pricing or offering or review your marketing. We have templates for a cash flow budget and profit & loss statement to help you prepare your projections for your first year of trading. We can also do some financial modelling to prepare some ‘what if’ calculations based on different price points.

Using industry benchmarks, we can help you get an understanding of the performance of your competitors. For a start-up business these can be invaluable because you have no financial track record and there is a lot of estimates and guess work when preparing a budget.

When you’re in start-up mode it’s hectic. It’s easy to get caught up in product development or bury your head in researching your customer’s habits and your competitor’s performance. Too often we see start-ups overestimate their revenue and underestimate their expenses. That often translates to a shortage of cash in the early stages which can be catastrophic. Your budget will also be a key document should you need to secure finance from a bank or third party.

6. The Price Is Right

Without doubt, one of the biggest mistakes that new business owners make is they try to get a toe hold in the market by undercutting their competitor’s prices. Being the cheapest is a risky strategy and while it might help attract some new customers, you run the risk of going broke.

Do your numbers and make sure you know your costs and break-even point. Again, we can help you do some financial modelling based on different price points that will help you understand the impact of different prices on your profitability.

Summary

The late Steve Jobs, Co-Founder, Chairman and CEO of Apple said, “Your work is going to fill a large part of your life, and the only way to be truly satisfied is to do what you believe is great work. And the

only way to do great work is to love what you do.” He inspired a lot of entrepreneurs but following your passion doesn’t guarantee a

lifetime of profits.

work is going to fill a large part of your life, and the only way to be truly satisfied is to do what you believe is great work. And the

only way to do great work is to love what you do.” He inspired a lot of entrepreneurs but following your passion doesn’t guarantee a

lifetime of profits.

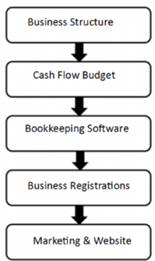

Starting a business is a process and there are numerous issues to consider including your choice of business structure and accounting software. You need to make decisions on your branding and marketing plus consider a range of business registrations. You’ll also need to think about your equipment requirements, finance and insurances. Of course, if you are looking to employ staff from the outset there are human resource issues including employment agreements, payroll software, workers compensation insurance plus superannuation guarantee obligations.

It can be a maze of issues that a business start-up needs to navigate through and as accountants we can clear the haze and provide advice on key issues including the preparation of a business plan, revenue forecasts, a cash flow budget, pricing, branding, marketing and insurances. We can also do some financial modelling to project your financial results based on different prices and costs.

Over the years, we have mentored hundreds of business owners through the start-up phase and along the way we have built a range of tools, templates and checklists to help you get your business off to a flying start. You can download our ‘New Business Starter Kit’ the from any page of our website and this 32 page e-Book contains an 82-point checklist of things to consider when starting a business. You also have access to a range of tools and templates that are stored in the resources section of our website.

As always, don't hesitate to contact us to discuss any aspects of this article.

This article forms part of our Business Accelerator Magazine. Download the latest edition HERE or browse other articles from this edition below:

- JobMaker Hiring Credits

- Recession Buster Edition #3 - How to Increase the Value of Your Average Sale

- Return to Top

Disclaimer: This newsletter contains general information only. No responsibility can be accepted for errors, omissions or possible misleading statements. No responsibility can be accepted for any action taken as a result of any information contained in these articles. It is not designed to be a substitute for professional advice and does not take into account your personal circumstances.