BUSINESS START UP CORNER

Home Is Where The Business Is

Some 800,000 people run a home based business in Australia. Many of them are start-ups, independent contractors or sole traders and the most common types of home based businesses include:

- Where home is the base for a business (e.g. tradespeople who mainly work at their client’s premises, but home is the operations base)

- The actual place of business (e.g. a hairdresser or beautician with a salon set up at home)

- A consultant or contractor with a home office, but they are often mobile

- Home is the base for an online business.

Running a business from home isn’t for everyone. When starting a home based business or setting up a home office for your business you should consider:

- Is the home suitable for clients, employees, neighbours and the neighbourhood?

- Do you have a separate entrance and wheelchair access?

- Do you need to check planning permits, licences and zoning?

- Do you need specific business insurances - check clauses in your house and contents insurance policy

- Claiming work related home expenses in your income tax return,

- If renting, does a home based business contravene your lease agreement?

- Check Occupational Health and Safety (OHS) at your house.

Registrations and Licences

When working from home, some businesses require special registrations or licences as well as a council planning permit. Use the Australian Business Licence and Information Service(ABLIS) to investigate which permits, registrations or licences you may need. Also, contact your local council for further advice on planning permits.

Insuring a Home Based Business

There is a common misconception that a standard house and contents insurance policy will provide adequate cover for home-based business activities. This is not the case and you need to ensure you have:

- public liability cover for persons visiting your home based business (e.g. customers and suppliers).

- business insurance for equipment, inventory, tools of trade, office furniture or computer equipment including fire, storm and theft and loss of any stock and equipment. Most domestic insurance policies don't cover your business tools of trade, office furniture or computer equipment without specific, itemised agreement from the insurer

- workers' compensation is compulsory if you have any employees working from your home.

- professional indemnity insurance if you're in a service industry, especially if you're contracting to government.

- costs arising from interruption to your business.

Tax Deductions for a Home Based Business

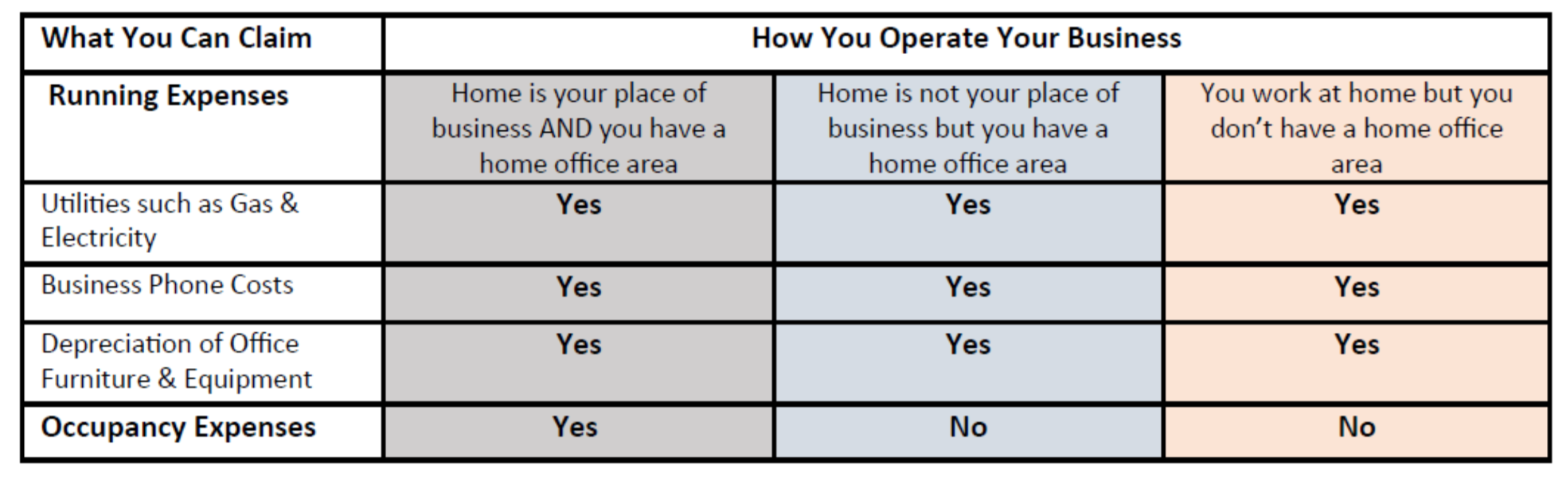

There are two categories of deductible expenses that can be claimed, running costs and occupancy expenses. Running costs include electricity, printer consumables, cleaning and telephone costs. Occupancy expenses include rent, mortgage interest, insurance premiums and council rates. If you set aside a specific work area then you can potentially claim both. If you haven't set aside a dedicated area for the business, then you can only claim a proportion of running expenses. If you carry on your business elsewhere and also do some work at home, you cannot claim occupancy expenses even if you have a specific area set aside as a home office.

Capital Gains Tax

If you use part of your home for business, you may expose the property to capital gains tax when you sell, even if you didn't claim any deductions for mortgage interest or occupancy costs when you ran the business. Contact us for more details.

Other articles in this edition:

- 7 Warning Signs Of A Business In Trouble

- There's An App For That - Printing From Your Mobile

- Reading Corner - Think and Grow Rich

- Time To Get Your Business Mobile Ready

- Tools To Create Great Business Videos

- Website Privacy Policies - Who, What, Where, When & How

- Avoid Termination Pitfalls

- Breaking News For Business Owners

IMPORTANT DISCLAIMER: This newsletter is issued as a guide to clients and for their private information. This newsletter does not constitute advice. Clients should not act solely on the basis of the material contained in this newsletter. Items herein are general comments only and do not convey advice per se. Also changes in legislation may occur quickly. We therefore recommend that our formal advice be sought before acting in any of these areas.